Here’s an article on “The Different Types of Life Insurance Policies Explained” designed for a life insurance website:

The Different Types of Life Insurance Policies Explained

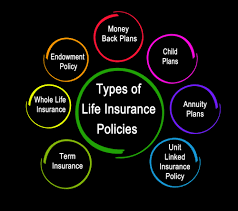

Life insurance can be a complex product with various options to choose from. Each type of life insurance policy offers distinct features and benefits, making it essential to understand the differences before selecting the right one for you and your family. In this article, we will explain the different types of life insurance policies, helping you make an informed decision about which policy best meets your needs.

1. Term Life Insurance

What is Term Life Insurance?

Term life insurance is the simplest and most affordable type of life insurance. As the name suggests, it provides coverage for a specific term or period, such as 10, 20, or 30 years. If you pass away during the term, your beneficiaries will receive the death benefit. However, if you outlive the term, the policy expires and does not provide any payout.

Key Features:

- Affordable premiums: Term life is generally the least expensive option.

- Fixed coverage: The death benefit remains the same throughout the term.

- No cash value: Term life insurance does not accumulate any cash value or investment component.

Best For:

- Individuals looking for affordable coverage.

- People who want life insurance to cover specific financial responsibilities, such as paying off a mortgage or funding children’s education.

- Those seeking coverage for a limited period (e.g., until retirement).

2. Whole Life Insurance

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue to pay premiums. In addition to a death benefit, whole life policies also build up cash value over time, which you can borrow against or withdraw (with potential tax implications).

Key Features:

- Lifetime coverage: The policy covers you for your entire life.

- Fixed premiums: Premiums are typically higher than term life but remain consistent throughout the life of the policy.

- Cash value accumulation: Whole life policies accumulate a cash value that grows tax-deferred over time.

- Guaranteed death benefit: The death benefit is guaranteed, and your beneficiaries will receive it when you pass away.

Best For:

- Individuals who want lifetime coverage with the added benefit of a cash value component.

- Those who are looking to leave a financial legacy or need insurance for estate planning.

- People who prefer predictable premiums over time.

3. Universal Life Insurance

What is Universal Life Insurance?

Universal life insurance is another type of permanent life insurance that provides flexible coverage. It offers a death benefit along with a cash value component, which earns interest based on the performance of the insurer’s general account. Unlike whole life, universal life allows you to adjust your premiums and death benefit as your needs change.

Key Features:

- Flexible premiums: You can adjust your premiums within certain limits. If you wish, you can pay more or less than the scheduled premium.

- Adjustable death benefit: You can increase or decrease the death benefit (subject to underwriting approval).

- Cash value accumulation: Universal life policies build cash value based on interest rates and are tax-deferred.

- Possible premium reductions: If your policy has accumulated enough cash value, you can use it to pay premiums.

Best For:

- People who want flexibility in their life insurance policy.

- Those with changing needs who may want to adjust their premiums or coverage over time.

- Individuals seeking permanent coverage with the ability to accumulate cash value.

4. Variable Life Insurance

What is Variable Life Insurance?

Variable life insurance is another form of permanent life insurance that combines a death benefit with an investment component. The cash value is invested in a variety of sub-accounts, such as stocks, bonds, or mutual funds. This gives policyholders the potential for greater returns, but also exposes them to investment risk.

Key Features:

- Investment options: The cash value can be invested in a variety of assets, giving you the opportunity for greater growth.

- Flexible premiums and death benefit: You can adjust premiums and death benefits within certain limits, much like universal life insurance.

- Investment risk: The value of the policy’s cash component can fluctuate depending on the performance of your chosen investments.

- No guaranteed cash value: Since the cash value is tied to market performance, there is no guarantee of growth.

Best For:

- People who are interested in combining life insurance with investment options.

- Those who have a higher risk tolerance and are comfortable with fluctuating cash value.

- Individuals who want permanent coverage and are looking to accumulate wealth through investments.

5. Indexed Universal Life Insurance (IUL)

What is Indexed Universal Life Insurance?

Indexed universal life insurance (IUL) is a type of universal life insurance that offers a cash value linked to a stock market index (e.g., the S&P 500). Unlike variable life insurance, the cash value in an IUL is not directly invested in the market but instead linked to the performance of the index. This provides the opportunity for higher returns than traditional universal life, with a level of protection against market downturns.

Key Features:

- Stock market index link: The cash value is tied to a stock market index, which means it can earn a higher return than traditional universal life policies.

- Guaranteed minimum interest rate: There’s typically a floor on the returns, so your cash value will not decrease if the market performs poorly (though the growth is limited).

- Flexible premiums and death benefits: Like other universal life policies, you can adjust premiums and death benefits as needed.

- Potential for higher returns: IUL policies can generate higher returns than traditional whole or universal life policies, depending on market performance.

Best For:

- Those who want the flexibility of universal life insurance with the potential for higher returns linked to market performance.

- Individuals seeking permanent life insurance coverage but with less exposure to risk than a variable life policy.

- People who are looking for an alternative investment vehicle within their life insurance policy.

6. Final Expense Insurance

What is Final Expense Insurance?

Final expense insurance is a type of life insurance designed to cover funeral and burial costs. These policies are typically smaller in value and are often purchased by older individuals who want to ensure that their family doesn’t have to bear the financial burden of funeral expenses.

Key Features:

- Small death benefit: Final expense policies typically provide a death benefit ranging from $2,000 to $50,000.

- Simplified underwriting: Many final expense policies do not require a medical exam and are easier to qualify for than other types of life insurance.

- Focused on funeral costs: The primary purpose is to cover end-of-life expenses, such as funeral, burial, and medical bills.

Best For:

- Seniors or individuals who want to ensure their loved ones are not burdened with funeral costs.

- People looking for affordable coverage to cover their final expenses.

- Those who may not qualify for other types of life insurance due to age or health conditions.

7. Group Life Insurance

What is Group Life Insurance?

Group life insurance is a policy typically provided by an employer or other organization. It offers coverage for a group of people, such as employees, at a relatively low cost. The coverage is usually basic, and you can often choose to purchase additional coverage.

Key Features:

- Affordable premiums: Group life insurance is typically less expensive than individual policies due to the shared risk among the group.

- Basic coverage: The death benefit is generally a set amount (e.g., one or two times your salary).

- Employer-sponsored: Often provided as a benefit through your workplace.

- Limited control: You may not have as much flexibility to adjust the coverage or premiums as you would with an individual policy.

Best For:

- Employees looking for affordable life insurance through their employer.

- Individuals who want basic coverage without having to undergo medical underwriting.

- People seeking additional coverage to supplement their employer-sponsored plan.

Final Thoughts

Choosing the right type of life insurance depends on your financial goals, coverage needs, and personal preferences. Whether you need temporary coverage, a lifelong policy, or a policy that allows for flexible premiums and investment opportunities, there is a life insurance option that fits your situation. Take the time to evaluate your needs and consult with a life insurance expert to find the best policy for you and your loved ones.

This article provides a comprehensive overview of the different types of life insurance policies available. By understanding the features and benefits of each type, you can make an informed decision that ensures the financial security of your family.

Leave a Reply